Maryland Retirement Planning

SageOne Financial

Retirement is personal. You’ve worked hard to save and invest your money and now it’s time to optimize and protect your savings to provide for your retirement and your loved ones thereafter.

SageOne Financial is an independent financial services firm, specializing in helping individuals and families prepare for, plan, and live in retirement. Our approach focuses on tailored retirement planning strategies and insurance solutions to provide our clients with guaranteed lifetime income, asset protection, and achieve tax efficiencies in support of a holistic approach to their finances.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

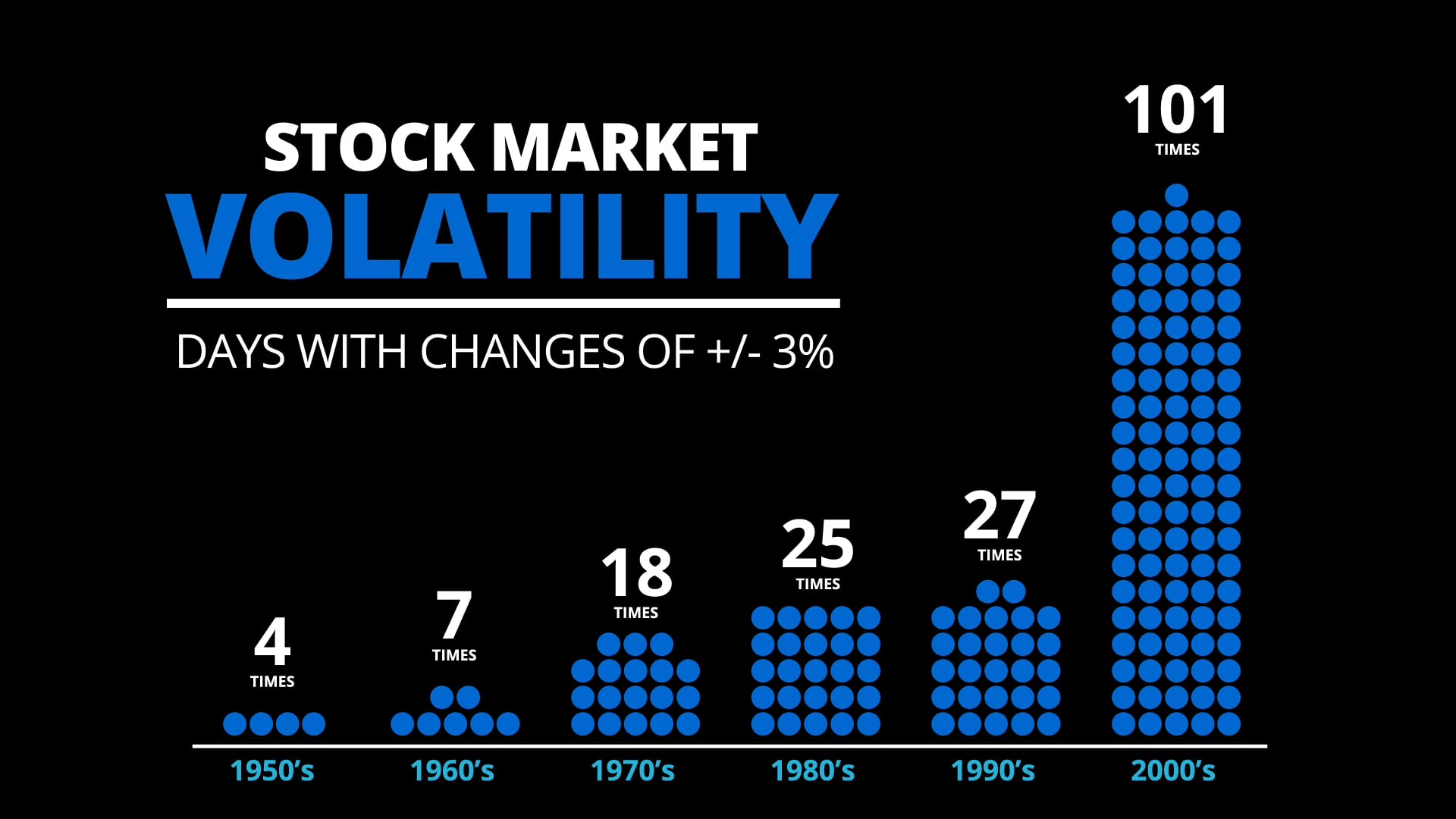

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Advisor

Dale A. Dicks

Co-Founder

Dale A. Dicks is a retired Marine Corps Officer with over 20 years of experience in leadership, management, logistics, operations and training, and human resources. Today, with over 25 years in the insurance industry, he specializes in providing a “total wealth solution”. Since retiring from Fannie Mae in December 2007, he has focused on positioning himself to attract and build a dynamic network of leaders, representing a formidable business capability. A Trusted Financial Educator, his background includes: mortgage originations, life insurance, and real estate sales and investing. Consequently, he is adept at assisting families with financial education, aggressive cash flow management and debt elimination, and tested and proven, non-traditional methods of wealth-building and asset protection. Dale founded SageOne Financial in Jan 2008 to pursue his ambitions and goals of building a top-producing, highly profitable team of financial services professionals. He became a Certified Financial Education Instructor with the National Financial Educators Council in Feb 2018, preparing to establish a non-profit and build a team of educators with the mission of Stamping-Out Financial Illiteracy across America.

SageOne Financial offers a wide array of practical financial services that meet clients’ needs optimally, efficiently, and cost-effectively. And, with an uncanny ability to take complicated financial concepts and make them simple and understandable, clients can trust SageOne Financial to present them with solutions that meet their needs and their budget.

SageOne Financial is striving to have a national presence, constantly expanding across the United States. If you are just starting out in your career and are open to the fast-paced and dynamic environment of financial services, we might be just the company for you. We have excellent training, marketing concepts, tools, and a learning culture conducive to nurturing growth and development for a successful financial career. Also, for the seasoned professional looking to make a career transition into a new and exciting field, you too might find just what you’re looking for with us.

So, if we can be of assistance to you with our myriad of services, and/or if you are looking for a new career in which you can truly thrive, contact us today. We are standing by to be of service!!

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Events in March 2026

- There are no events scheduled during these dates.

Our Downloads

Legacy & Estate Planning; Understanding the Basics

Estate planning is an important part of retirement planning. You’ve worked hard for your money and want to see your children and grandchildren benefit, and you probably want to see it passed down in the most efficient way possible. Unfortunately, costly mistakes are all too easy to make, from forgetting to name a beneficiary on your retirement account to not updating your estate plan over time. It’s not just billionaires who need to have solid estate plans; it’s anyone who wants their wishes to be honored after their passing.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.